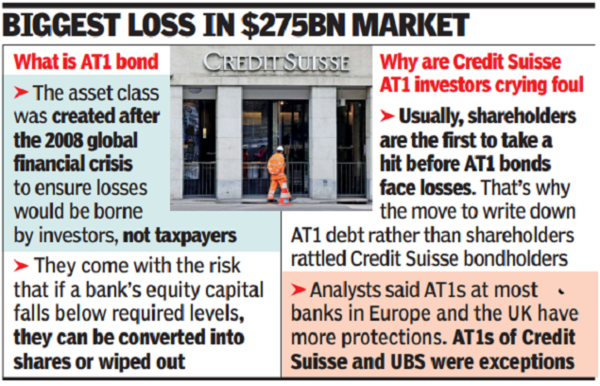

Money managers are frantically poring through the fine print for these socalled additional tier1 (AT1) securities to understand if authorities in other countries could repeat what the Swiss government did on Sunday: Wiping them out while preserving $3.3 billion of value for equity investors. That’s not supposed to be the pecking order, some holders in the bonds insist.

As a direct consequence, AT1 bonds of European lenders like Deutsche Bank, Unicaja Banco, Raiffeisen Bank International and BNP Paribas plunged on Monday to record lows. Deutsche Bank’s $792 million note recorded its biggestever oneday decline. It’s the biggest loss yet for Europe’s AT1 market, which was created after the financial crisis to ensure losses would be borne by investors not taxpayers.

One UK bank CEO put it bluntly: The Swiss have killed this key corner of funding for lenders, he said, asking not to be named because the situation is sensitive. His comments underscore how the global financial community is on edge after the UBS takeover of Credit Suisse, which came on the heels of the collapse of three regional US banks. European regulators reiterated on Monday that equities should take losses before bonds.

Source link

2: https://timesofindia.indiatimes.com/business/international-business/risky-at1-bonds-sink-due-to-17bn-credit-suisse-wipeout/articleshow/98839685.cms

The Mention Sources Can Contact is to remove/Changing this articles